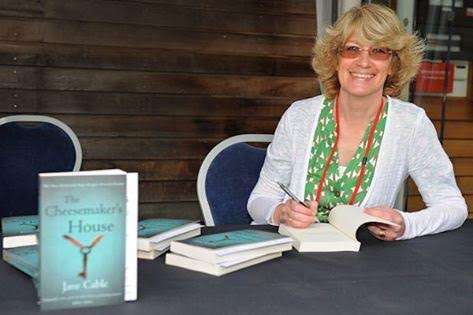

Jane Cable on taxing income from writing

Jane Cable on taxing income from writing

The first royalty cheque, the first receipts from Amazon – those are exciting moments for any writer. But in the slightly bewildered ‘wow – someone’s paid to read my book’ moment, whether you need to pay tax on the income is the furthest thing from your mind.

First let me say that taxation – any form of taxation – is a minefield. The volume of legislation is massive and while HMRC guidance is helpful and now provided in reasonably understandable lay terms, it is still easy to fall foul of the rules – or at very least not take full advantage of them. If you even think you might need professional advice then talk to an accountant – preferably a qualified one. Most offer free initial meetings and if you can’t find one by recommendation then the ICAEW’s Business Advice Service is a good place to start: http://www.businessadviceservice.com/

Assuming you haven’t set up a company for your writing business then your earnings from the business of books will be classed as self employment. This means that you won’t be taxed on your income, but on your profit. In broad terms, many costs which relate solely to your writing will be allowable for tax, including book production, marketing, attending conferences and agents’ fees. The list is not exhaustive but a good first question to ask yourself is ‘did I do that only for my writing business and was it necessary to do it?’ If the answer is yes, then you are more than half way there but the reality is that a good accountant will be able to maximise what you claim because they will know the laws inside out.

For the tax year just started, things will be quite a lot simpler for the majority of writers who have self employed earnings of under £1,000 per annum. Here I am talking about gross income, before any expenses. This is because the government has introduced a new limit below which HMRC doesn’t even need to know about it. The exception to this is if you already complete a tax return but even then the rules are relatively simple and you can read more about them here: https://www.gov.uk/guidance/tax-free-allowances-on-property-and-trading-income

Of course another issue is whether you are trading or not with your writing, or if it’s just a hobby. Working out when a writer crosses the line is a matter of judgment – and case law – and everyone’s circumstances will be different. The key ingredient is whether you are doing it with a view to making a profit (one day, if not now) but once you actually start selling books, then you probably are.

There is a good chance you might be trading before that day, but this is where the waters become unbelievable muddy. Why would it matter, you may ask yourself, because if I don’t have any income then I’m not making taxable profits. The answer is that you might be making a taxable loss which can be used to reduce the tax on your other income. And this is where professional advice is essential because it’s also where HMRC can become mighty interested and in 2015 they won a landmark case where a tax tribunal decided that someone who had a full time job but poured money into a hobby they loved was not trading so couldn’t claim tax relief. Even though they made a little income from it. Even though they had a professionally designed website. It struck me at the time that the circumstances were pretty similar to most authors when they set out in their writing careers.

The new £1,000 tax free allowance will undoubtedly make things easier for those setting up many businesses, including writing, which can only be a good thing. But remember it’s only half the story. And never, ever, mess with the Inland Revenue!

Please note that this article only points out general rules and should not be used as a substitute for professional advice.