When purchasing an older home, there are various ways by which you can work to renovate it to your liking. Whether you plan on living there, or perhaps are trying to flip the house for more money, making a house look more modern and accessible doesn’t have to be that hard. In this article, we’ll cover some of the ways you can go about making your house modern for a great and comfortable living experience.

When purchasing an older home, there are various ways by which you can work to renovate it to your liking. Whether you plan on living there, or perhaps are trying to flip the house for more money, making a house look more modern and accessible doesn’t have to be that hard. In this article, we’ll cover some of the ways you can go about making your house modern for a great and comfortable living experience.

Furniture

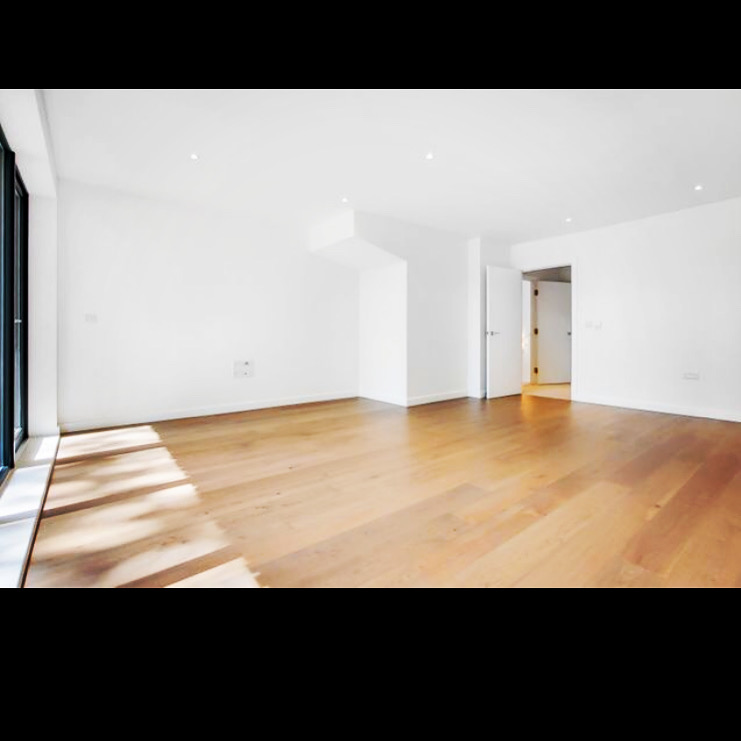

When purchasing new furniture, the new style is all about open space. Whenever you visit an old house, you may see a lot of clutter as well as big and bulky furniture. When designing your new interior for your house, you’ll want to find furniture that keeps your house spacious. Oftentimes, clutter can make a nice house otherwise look unattractive to others.

Painting

Having a nice color coat on your wall and ceiling can make a big difference. When purchasing a new paint color, try to take into consideration what you want to include in your room. Many times drape colors can clash with the color of the walls. Other times, dark colors can make a room feel like a basement.

You’ll want to find light colors that can light up the room while sunny outside. Another idea would be to find a room theme of your liking and match it with an appropriate color. For example, a light green or blue may go well with a room filled with plants as well as certain types of furniture.

Interior Decor

Decorating your new home doesn’t have to be a hassle. Have fun with it. When adding decorations like pictures to the wall, plants, paintings, or even vases and other antiques, keep in mind your ideal room design.

Sometimes over cluttering a room with too many decorations or trinkets can prove to be bad in the end. If you’re in the process of decorating your house, keep things spaced out and in safe locations where things are not easily broken. For example, rather than putting an antique in the middle of the coffee table, putting it on the side near a lampstand away from possible danger may be the best idea.

Remodeling

Sometimes old houses can be stuffy and cluttered as is. You may want to combine two rooms for more space. Another aspect most modern houses offer is large windows. Allowing natural light into your house is usually favored by most people.

Summing it Up

If you’re like most people, you’ll want to learn more about the best way to remodel your house. You can learn more online at various websites. For those looking for some info on finding great houses for sale and rent and home insurance, click here now.

Sponsored Post.