Homeowners are expected to save on average £2,158.47 per year for home repairs

58% of first time buyers would prefer to buy a new build over an older building

Over a quarter of Brits said that fixing a roof was their most concerning home repair

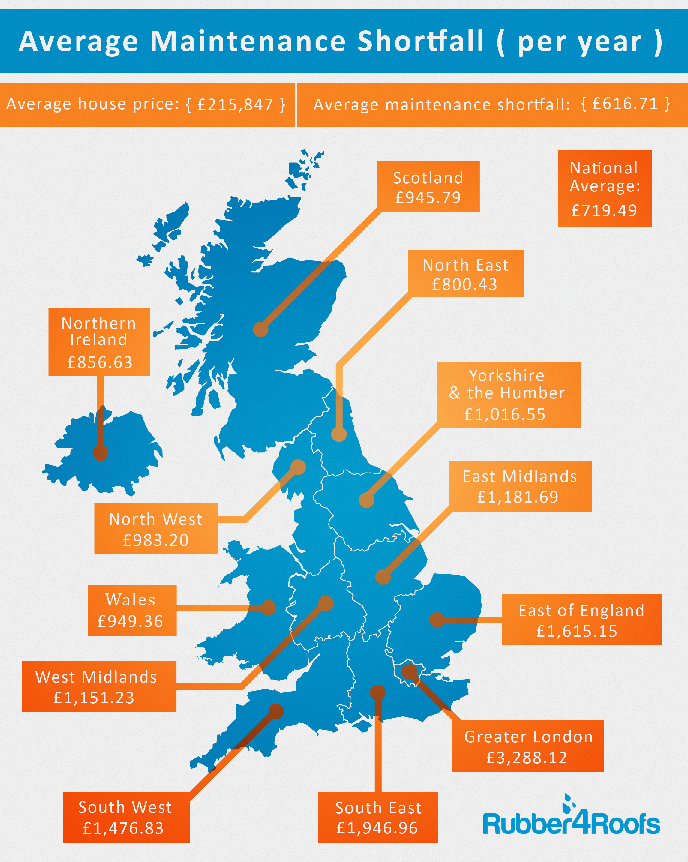

Infographic map included showing the average maintenance shortfall (per year) across the UK

Unexpected disasters are the worst – they catch us by surprise, and mean we have to search frantically for a solution. If an unexpected disaster happens in our home, that usually means the solution will involve money – and probably lots of it – to fix what’s gone wrong. In an ideal world, we’d have a little pot of cash stored away for exactly these kinds of problems. Housing experts agree that sensible homeowners should budget 1% of the value of their property every year to maintenance and property repair. And with the average house price in the UK being £215,847, that means we should have a home improvement and repair account to the tune of £2,158.47 per year. But how many of us do that? Not enough, apparently. Rubber roofing specialists Rubber4Roofs surveyed 3,000 UK homeowners to find out what their home-fixing slush fund was worth. Taken on average, they found that Brits only budget £1,438.98; that’s a national shortfall of £719 (or 33% less than what they should be budgeting). Not ideal if your boiler suddenly breaks down over the winter, or your washing machine suddenly springs a leak.

But while that’s the UK average, some regions are doing even worse, as the infographic below illustrates:

As you would expect with such high property prices, Greater London comes out on top (well, bottom) with an average budget shortfall of £3,288. That’s a big gap, particularly if something major goes wrong with your house. That could also be because the cost of living is substantially higher here, so that people don’t manage to save that much (plus all those metropolitan cappuccinos and avocados on toast don’t come cheap…). Close on their heels is the South East of England, with a gap of £1,947.

The money-savviest region, in contrast, is the North East – they’re only short by £800, not that much more than the national average. They know the value of a penny or two up there! But regardless of how much you do or don’t have saved, many of us are likely to put the cost of any repairs straight onto a credit card, thus delaying the pain of parting with actual cash – nearly a fifth of us do this.

Rubber4Roofs also asked first time buyers whether they preferred new builds, or older buildings; over half of them (58%) said new builds, presumably because fewer things were likely to go wrong – well, not in the first few years at any rate! But when asked which type of repair worried homeowners the most, due to the cost, the majority of them said roof repairs. Over a quarter of us (27.5%) know that this is usually a substantial cost, due to the nature of the work needing to be done, from the risk of sending workers onto the roof, to the heavy graft needed to fix any holes or leaks. Though you might want to avoid any future issues by installing rubber roofing instead: it’s a single-ply synthetic membrane you can use on low-sloping or flat roofs because it’s durable, pliable and waterproof; the benefit is that, although the cost difference to traditional flat roofing materials is negligible, rubber roofing has a life expectancy of 50 years which is up to 5 times as long.

This was closely followed by plumbing issues (26.5%); again, when something goes wrong and you’re left with indoor flooding, caused by anything from a blocked loo to overflowing drains, it’s not going to come cheap. Fixing foundations (18.5%) and removing mould (17.5%) were also concerns, due to the amount of work and associated costs involved. Few of us worry about electrical issues (7%) as that usually seems pretty straightforward, usually involving a change of wiring or a fuse, and the least problematic repair is repairing the drain pipe (3%).

‘It looks like Brits might have to start putting a little bit more away each month to ensure they’re covered for unforeseen repairs,’ says Tom Cullingford, owner at Rubber4Roofs. ‘There’s nothing worse than the headache of a major housing issue, coupled with the headache of trying to find the money to pay for it. But putting precautions in place, such as installing rubber roofing, can save time and money in the long run.’